While reading articles from Peter's blog and his watching his interview videos on YouTube I observed that Peter often mentions 'Market Efficiency' and he says that the markets are efficient, in fact too efficient at times.

It is often debated that the Efficient Market Hypothesis (EMH) does not hold true in the financial (equity) markets, so why then should the betting exchange markets be efficient? And, if indeed the betting exchange markets are very efficient, then it would be safe to assume that it would be difficult to find 'Value'.

I am a bit confused and would be grateful to anyone that can provide an insight into:

What is Market efficiency (at least as far betting exchanges are concerned)?

How is it measured (it's components - such as information, emotions, volume, volatility etc.)?

And I've got one more question interconnected with the previous question based on another article I remember reading where Peter says, "If I cannot model a market I will not trade it."

How does one model a market? And what parameters/components are involved in framing a market?

Thank you to all in advance for sharing your thoughts.

And Thanks a Million to you Peter Webb for the wealth of information and ideas you share through your blog.

Market Efficiency and Framing a Market

I wrote both my BSC and MSC theses about this topic (I'm no way expert, just have some info about it). There are various models and methodologies to measure efficiency, one of the easy to understand ones is the event study methodology. ( http://en.wikipedia.org/wiki/Event_study )

EHM assumes, that all information is incorporated into the share prices, and there is no difference between the real value and the price of the share. My findings showed quite the opposite though. In both set of data that I've examined I could identify a strong overreaction (several %s)of the market to a given news, which was then corrected within 1-4 days.

But this is the financial market, with way more analysts, money circulating, and less volatility than the sports market. Also, people are way more biased in sports betting than in investing, which can have a strong influence on the market.

EHM also implies that no one investor can effect the stock price to one or other direction, as the market corrects immediately. This has been proven wrong over and over in history, with big investors killing the FX market of given countries (even as big as the UK), making a fortune out of it.

At the same time, even with a few thousang bucks you can make a difference on betfair in a not so liquid market. Try it yourself.

All the previous differences I've highlighted in favor of the financial markets are supporting a more efficient market. And as I've found and seen various cases of the financial markets not being efficient, why would sport betting markets be?

These lead to the conclusion of mine, that betting markets are not efficient, and you can find an edge. Even higher, than on financial markets.

EHM assumes, that all information is incorporated into the share prices, and there is no difference between the real value and the price of the share. My findings showed quite the opposite though. In both set of data that I've examined I could identify a strong overreaction (several %s)of the market to a given news, which was then corrected within 1-4 days.

But this is the financial market, with way more analysts, money circulating, and less volatility than the sports market. Also, people are way more biased in sports betting than in investing, which can have a strong influence on the market.

EHM also implies that no one investor can effect the stock price to one or other direction, as the market corrects immediately. This has been proven wrong over and over in history, with big investors killing the FX market of given countries (even as big as the UK), making a fortune out of it.

At the same time, even with a few thousang bucks you can make a difference on betfair in a not so liquid market. Try it yourself.

All the previous differences I've highlighted in favor of the financial markets are supporting a more efficient market. And as I've found and seen various cases of the financial markets not being efficient, why would sport betting markets be?

These lead to the conclusion of mine, that betting markets are not efficient, and you can find an edge. Even higher, than on financial markets.

Switesh

Betting markets are efficient but only at the high level and only over a large number of races.If you backed every horse that was say 4.0 in every race covered by Betfair and didn't pay any commission or PC then long term you will find that your strike rate will be about 25% and will break even.This is as far as market efficiency goes.Because of the commission and PC you will lose long term because your strike rate will not be high enough to overcome commission and the PC.In order to make money you therefore have to be selective.Because the markets are only efficient at the high level they may not necessarily be efficient at the low level(a given horse in a given race).If they were then the only winner would be Betfair and every single Betfair customer would lose long term.Because some Betfair customers win long term the market on certain horses in certain races cannot be efficient.In other words there must be horses that have value.If a horse is trading at 4.0 it has a 25% theoretical chance of winning.If it's actual chance of winning is 50% it has backing value of 50-25=25%. Because the market is efficient at the race level there must be a number of horses in the same race whose laying value adds up to 25%.You can measure market efficiency by arranging in sequence the BSP of each horse in each race over a prolonged period and then calculating the strike rate.For example you will see that the strike rate for horses with a BSP of 3.0 will have a strike rate of about 33.33% and the strike rate of horses with a BSP of 10.0 will have a strike rate of about 10%.As for the rest of the information you require I cannot help.

Betting markets are efficient but only at the high level and only over a large number of races.If you backed every horse that was say 4.0 in every race covered by Betfair and didn't pay any commission or PC then long term you will find that your strike rate will be about 25% and will break even.This is as far as market efficiency goes.Because of the commission and PC you will lose long term because your strike rate will not be high enough to overcome commission and the PC.In order to make money you therefore have to be selective.Because the markets are only efficient at the high level they may not necessarily be efficient at the low level(a given horse in a given race).If they were then the only winner would be Betfair and every single Betfair customer would lose long term.Because some Betfair customers win long term the market on certain horses in certain races cannot be efficient.In other words there must be horses that have value.If a horse is trading at 4.0 it has a 25% theoretical chance of winning.If it's actual chance of winning is 50% it has backing value of 50-25=25%. Because the market is efficient at the race level there must be a number of horses in the same race whose laying value adds up to 25%.You can measure market efficiency by arranging in sequence the BSP of each horse in each race over a prolonged period and then calculating the strike rate.For example you will see that the strike rate for horses with a BSP of 3.0 will have a strike rate of about 33.33% and the strike rate of horses with a BSP of 10.0 will have a strike rate of about 10%.As for the rest of the information you require I cannot help.

- superfrank

- Posts: 2762

- Joined: Fri Aug 14, 2009 8:28 pm

good post sbsbfan, i agree.

in the short term markets are primarily driven news and sentiment (which can be fickle and therefore present opportunities).

this is an interesting piece about the performance of the S&P500 last year (in short it swung all over the place but by the end of the year had only moved a few points)...

In 2011, The S&P Moved 877 Times For Every Point Of Change

http://www.zerohedge.com/news/2011-sp-m ... int-change

i base my short-term financial trading on the assumption that the market is not always efficient and trade that view with variously correlated/co-integrated instruments (http://www.co-integration.com/). For me it's the only way to approach short-term trading, unless you have a crystal ball, inside info or the means to manipulate the market for short periods.

in the short term markets are primarily driven news and sentiment (which can be fickle and therefore present opportunities).

this is an interesting piece about the performance of the S&P500 last year (in short it swung all over the place but by the end of the year had only moved a few points)...

In 2011, The S&P Moved 877 Times For Every Point Of Change

http://www.zerohedge.com/news/2011-sp-m ... int-change

i base my short-term financial trading on the assumption that the market is not always efficient and trade that view with variously correlated/co-integrated instruments (http://www.co-integration.com/). For me it's the only way to approach short-term trading, unless you have a crystal ball, inside info or the means to manipulate the market for short periods.

Last edited by superfrank on Tue Feb 14, 2012 11:22 am, edited 1 time in total.

- superfrank

- Posts: 2762

- Joined: Fri Aug 14, 2009 8:28 pm

foreign exchange markets are also a zero sum game (that fact doesn't necessarily make the performance of individual currencies any more efficient).John Doe wrote:Sports are more efficient because the market has to be priced at 100%. Financial markets rise and fall like the tide whether the underlying company is priced correctly or not.

- CaerMyrddin

- Posts: 1271

- Joined: Mon Sep 07, 2009 10:47 am

Really interesting thread.

Even if the market was perfectly efficient, you would always be able to make money, firtly because there is always a margin between backing and laying, secondly because there is a book percentange you can exploit (dutching or bookmaking the whole field) and last but not least, because there is always new information hitting the market that will make market participants change their mind about where the value is.

Even if the market was perfectly efficient, you would always be able to make money, firtly because there is always a margin between backing and laying, secondly because there is a book percentange you can exploit (dutching or bookmaking the whole field) and last but not least, because there is always new information hitting the market that will make market participants change their mind about where the value is.

74.5

Thank you for pointing out that markets are efficient on a much broader level and over a period of time, rather than at at any individual game/race level. I can only conclude that because the markets are inefficient at smaller levels (few minutes before the off/in-play) it must be here that Opportunities exist.

sbsbfan

Thanks for the points you made in your posts. I can certainly relate to the fact that placing an order larger than what the market can absorb can certainly influence the markets. This reminds me of another one of Peter's articles where he mentioned that on certain markets if he got his staking wrong then the money on the other side would quickly disappear and he would sense fear among the them.

Thank you for pointing out that markets are efficient on a much broader level and over a period of time, rather than at at any individual game/race level. I can only conclude that because the markets are inefficient at smaller levels (few minutes before the off/in-play) it must be here that Opportunities exist.

sbsbfan

Thanks for the points you made in your posts. I can certainly relate to the fact that placing an order larger than what the market can absorb can certainly influence the markets. This reminds me of another one of Peter's articles where he mentioned that on certain markets if he got his staking wrong then the money on the other side would quickly disappear and he would sense fear among the them.

Switeshswitesh wrote:74.5

Thank you for pointing out that markets are efficient on a much broader level and over a period of time, rather than at at any individual game/race level. I can only conclude that because the markets are inefficient at smaller levels (few minutes before the off/in-play) it must be here that Opportunities exist.

Sports markets at the game/race level I believe are efficient all of the time and inefficient at the horse/team level for the vast majority of the time and not just close to the off/in-play.Whenever a sports market moves a team/horse will gain/lose backing/ laying value.The real problem with a sports market is deciding on the odds which represent zero value for each horse/team and then looking to see which horse's/team's actual odds are the furthest away from their theoretical (zero-value) odds and then backing/laying as appropriate.For example if you think that a horse's odds ought to be 3.0 (zero-value odds) and it is currently trading at 3.05 then it only has 1.67% backing value.If you think that a horse's odds ought to be 3.0 (zero-value odds) and it is currently trading at 2.0 then it has 33% laying value. Personally,I'd lay the 2.0 horse rather than back the 3.05 horse.The whole thing unravels if you cannot determine what the zero-value odds ought to be.I guess that's why some people trade.All they need to do is figure out how the odds are gonna move.I say ALL.I've never been any good at it.

Here's Peter's blog on 'The efficiency of the betting exchange markets'

http://www.probabilitytheory.info/conte ... ge-markets

One of the point I failed to grasp in the 'Actual probability' section of the article was the bit that reads "I have not taken a snapshot of the market at any one point or used the SP or a default time to capture the odds. This is all odds offered at all times in the market."

What does Peter mean by odds offered at all times? As we know that the odds vary all the time. Does he mean the sum average of the odds range?

Anyone care to clarify?

The last line in the same section caught my attention as well. It reads "I have also studied when the market is most efficient, but that's another story."

Peter, would you care to write an article on this please.

Much obliged to you!

http://www.probabilitytheory.info/conte ... ge-markets

One of the point I failed to grasp in the 'Actual probability' section of the article was the bit that reads "I have not taken a snapshot of the market at any one point or used the SP or a default time to capture the odds. This is all odds offered at all times in the market."

What does Peter mean by odds offered at all times? As we know that the odds vary all the time. Does he mean the sum average of the odds range?

Anyone care to clarify?

The last line in the same section caught my attention as well. It reads "I have also studied when the market is most efficient, but that's another story."

Peter, would you care to write an article on this please.

Much obliged to you!

Peter's article is excellent.

What does Peter mean by odds offered at all times? As we know that the odds vary all the time. Does he mean the sum average of the odds range?

What I think Peter means is this:If the same horse was offered at odds of 3.1, 3.2, 3.3. 3.4 & 3.5 at various points throughout the betting day then each set of odds is treated separately.If the horse won then it would increase the strike rate of all of the horses that traded at 3.1, 3.2, 3.3. 3.4 & 3.5.If the horse lost then it would decrease the strike rate of all of the horses that traded at 3.1, 3.2, 3.3. 3.4 & 3.5.But you are better asking Peter exactly what he meant.The bottom line is:If you don't have and edge, you will lose long term.

As for:"I have also studied when the market is most efficient, but that's another story."I've done a lot of reading on this subject and done some research.What I concluded was that the market is at its most efficient at the off.To be precise it's the odds that the last bet on each horse was matched at just before the off.If this is what Peter found then there is a problem.In order to make a consistent long term profit you need to back at odds which are greater than those at the off and/or lay at odds which are less than those at the off.Because you don't know what the odds at the off are going to be you can't do this.

Let's consider a backer who only backs horses at 2.0 to win.Peter tells us that 50% win and 50% lose.To win long term he needs to eliminate as many losing bets as possible.Most people use some kind of system to do this and most fail.Let's consider a layer who only lays horses at 4.0 to lose.Peter tells us that 25% win and 75% lose.To win long term he needs to eliminate as many losing bets (winning horses) as possible.Most people use some kind of system to do this and most fail.In the end they turn to trading in the hope of finding success because ALL you have to do is to determine which way the odds will move and place appropriate bets.This is much easier than picking winners/losers they feel.Apologies to traders at this point.I'm not suggesting that traders are failed backers/layers.It's just that this is how most of my mates got into trading.

74.5

What does Peter mean by odds offered at all times? As we know that the odds vary all the time. Does he mean the sum average of the odds range?

What I think Peter means is this:If the same horse was offered at odds of 3.1, 3.2, 3.3. 3.4 & 3.5 at various points throughout the betting day then each set of odds is treated separately.If the horse won then it would increase the strike rate of all of the horses that traded at 3.1, 3.2, 3.3. 3.4 & 3.5.If the horse lost then it would decrease the strike rate of all of the horses that traded at 3.1, 3.2, 3.3. 3.4 & 3.5.But you are better asking Peter exactly what he meant.The bottom line is:If you don't have and edge, you will lose long term.

As for:"I have also studied when the market is most efficient, but that's another story."I've done a lot of reading on this subject and done some research.What I concluded was that the market is at its most efficient at the off.To be precise it's the odds that the last bet on each horse was matched at just before the off.If this is what Peter found then there is a problem.In order to make a consistent long term profit you need to back at odds which are greater than those at the off and/or lay at odds which are less than those at the off.Because you don't know what the odds at the off are going to be you can't do this.

Let's consider a backer who only backs horses at 2.0 to win.Peter tells us that 50% win and 50% lose.To win long term he needs to eliminate as many losing bets as possible.Most people use some kind of system to do this and most fail.Let's consider a layer who only lays horses at 4.0 to lose.Peter tells us that 25% win and 75% lose.To win long term he needs to eliminate as many losing bets (winning horses) as possible.Most people use some kind of system to do this and most fail.In the end they turn to trading in the hope of finding success because ALL you have to do is to determine which way the odds will move and place appropriate bets.This is much easier than picking winners/losers they feel.Apologies to traders at this point.I'm not suggesting that traders are failed backers/layers.It's just that this is how most of my mates got into trading.

74.5

Just noticed this thread.

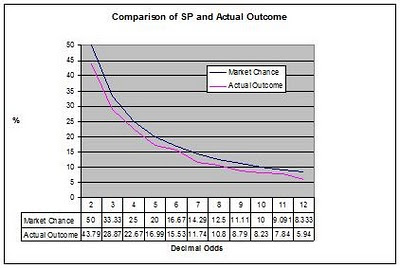

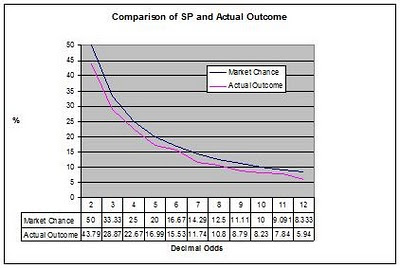

I have done EMH in my BSc too and plotted win rate against expected probability from SP. Indeed the wisdom of the betting crowd is very efficient.

See here for the graph...

With Betfair offering near 100% books and an API now is a great time to be investigating the markets through sports trading. So much so that I was offered a place at Oxford to return to study after 20 years out of academia to do a masters. And you can be sure that Betfair will play a large part of my research come October.

I have done EMH in my BSc too and plotted win rate against expected probability from SP. Indeed the wisdom of the betting crowd is very efficient.

See here for the graph...

With Betfair offering near 100% books and an API now is a great time to be investigating the markets through sports trading. So much so that I was offered a place at Oxford to return to study after 20 years out of academia to do a masters. And you can be sure that Betfair will play a large part of my research come October.

It seems to me that in this the way in which you calculate efficiency seems to matter. Also with regards to when the market is most efficient, in horse racing it would make sense for the market to be most efficient when the uncertainties are reduced as much as possible, which means when the market knows as much as possible, which suggests the market is most efficient after we've seen the horses in the paddock and loaded. From this, it makes sense that the start price is the most efficient. Whether or not this is true would require back-testing, maybe someone else can provide insight?

I'll see you there (well, ok, probably not). I'll be an undergradJayBee66 wrote: So much so that I was offered a place at Oxford to return to study after 20 years out of academia to do a masters.

Maybe there is some part of my brain that is missing a trick but I do not believe that the Betfair markets are "efficient" at any time. And as for claiming that a market price is "efficient", there is no meaning to this statement that makes any logical sense. A market price can only be "accurate" or not; and its final value may or may not be arrived at "efficiently".

Efficient: Achieving maximum productivity with minimum wasted effort or expense.

If you were to ask what is the most efficient way to form a market then arriving at a price would certainly take a different route than it does in Betfair. At no time (in most races) are the odds accurate since every man and his dog knows that the "most accurate odds" are established very close to the off time, having taken a circuitous route that may take it on a journey as far as 50% or more away from its final "accuracy". I have claimed before that the fact that SP strongly correlates with Actual results is not proof that SP odds are "accurate" but rather that by manipulation of odds over many many events, the sum total of odds verses results can be made to appear in sync. No single event can be isolated as evidence of the theorem.

The route taken by odds, especially in the final 10 minutes, is proof that odds can certainly NOT be described as "accurate" for the vast majority of that 10 minute period and only finally arrives at its most accurate value at the off time.

The question as to whether the trading process practised in Betfair is efficient has to consider that evidentially odds do swing, sometimes quite wildly and there are clearly not taking the most efficient path; unless motorists who want to get from Birmingham to Manchester think that efficiency means travelling though Devon and Aberdeen several times.

Another thought provoking question is whether bookmakers follow traders or vice versa on Betfair and Peter says "There is much debate about who follows who on the betting exchanges. Do bookmakers lead the betting exchange price or do the betting exchanges lead the bookmakers? I would have argued in the early days that it was definitely bookmakers that led exchanges. But now I think most people reference exchanges before accepting or pricing just before the off".

Anyone who trades on Betfair regularly on the pre race markets does so by following the the odds action. It is rare for traders to "make" markets and most traders (and there are fewer than most people realise) earn a crust by capitalising on odds movement without intentionally creating those movements themselves. Now if Bookmakers are also following the odds on Betfair and adjusting their own books accordingly then it begs the question as to exactly "Who" is driving the odds up or down in an extremely inefficient manner so as to arrive at a seemingly accurate price by the off time?

Efficient: Achieving maximum productivity with minimum wasted effort or expense.

If you were to ask what is the most efficient way to form a market then arriving at a price would certainly take a different route than it does in Betfair. At no time (in most races) are the odds accurate since every man and his dog knows that the "most accurate odds" are established very close to the off time, having taken a circuitous route that may take it on a journey as far as 50% or more away from its final "accuracy". I have claimed before that the fact that SP strongly correlates with Actual results is not proof that SP odds are "accurate" but rather that by manipulation of odds over many many events, the sum total of odds verses results can be made to appear in sync. No single event can be isolated as evidence of the theorem.

The route taken by odds, especially in the final 10 minutes, is proof that odds can certainly NOT be described as "accurate" for the vast majority of that 10 minute period and only finally arrives at its most accurate value at the off time.

The question as to whether the trading process practised in Betfair is efficient has to consider that evidentially odds do swing, sometimes quite wildly and there are clearly not taking the most efficient path; unless motorists who want to get from Birmingham to Manchester think that efficiency means travelling though Devon and Aberdeen several times.

Another thought provoking question is whether bookmakers follow traders or vice versa on Betfair and Peter says "There is much debate about who follows who on the betting exchanges. Do bookmakers lead the betting exchange price or do the betting exchanges lead the bookmakers? I would have argued in the early days that it was definitely bookmakers that led exchanges. But now I think most people reference exchanges before accepting or pricing just before the off".

Anyone who trades on Betfair regularly on the pre race markets does so by following the the odds action. It is rare for traders to "make" markets and most traders (and there are fewer than most people realise) earn a crust by capitalising on odds movement without intentionally creating those movements themselves. Now if Bookmakers are also following the odds on Betfair and adjusting their own books accordingly then it begs the question as to exactly "Who" is driving the odds up or down in an extremely inefficient manner so as to arrive at a seemingly accurate price by the off time?

JamesJames1st wrote:Maybe there is some part of my brain that is missing a trick but I do not believe that the Betfair markets are "efficient" at any time. And as for claiming that a market price is "efficient", there is no meaning to this statement that makes any logical sense. A market price can only be "accurate" or not; and its final value may or may not be arrived at "efficiently".

Efficient: Achieving maximum productivity with minimum wasted effort or expense.

When the good folks state that betfair markets are efficient,they are not stating that a particular market on a particular horse in a particular race is efficient for clearly that is a nonsense.For the statement to be true, in the win market for example, the back odds of the eventual winner,at the off, would have to be 0 and those of the losing horses would have to be infinity.When people state that betfair markets are efficient,what they really mean is that they are efficient over all the horses in a large number of races.So,if we take a large number of horses whose betfair odds,at the off,are 2.0,then, in theory,50% of them should win.In practice,we find that approximately 50% of them do win.In that sense,the betfair markets are efficient.What they don't mean is that they are efficient for a given horse in a given race.

Moving on from this,there is an implication.If we were to select a large number of horses at random and backed them to win,we would find that,on average,we will break even if there was no betfair commission (if only).With commission,we will find that we will,on average,lose.

Moving on from this,there is a further implication.If we wish to win long term (don't we all),we must be selective in which horses we back and/or lay.We must back horses whose odds are greater than their theoretical chances of winning and lay those whose odds are less than their theoretical chances of winning.If we do this then,long-term,we will win.The only issue here is:correctly assessing a horse's theoretical chances of winning.Because markets are only efficient over the long term and because every single market on every single horse is incorrect,in theory,we do have a theoretical chance of winning long term,provided that we are either initially lucky or we have a large enough bank to withstand possible initial losses due to randomness.

Moving on further:Most people will lose,long term,for the following reasons:

1.Too many people fail to correctly assess the effects of randomness.For example,even a winning system can go through horrendously long losing runs.

2.Too many people are unable to correctly assess the actual chances of a horse winning.

3.Humans are,by nature,optimistic and tend to discount the negative.There was a recent Horizon program which showed this.Therefore,when a system goes through a particularly bad period,we are usually ill-prepared.

I guess that's why failed backers and layers turn to trading.At least it eliminates point 2 above - and that's one less issue they have to concern themselves with.

IMHO,the above explains why there are many, many losers in this game and precious few winners.The odds are heavily stacked against us.

PS. I realise that betfair should begin with a capital letter.Because they treat their customers in such a deplorable way,I have deliberately chosen not to afford them the courtesy.

74.5